It's why we're here

Deutsche Bank was founded to connect Germany to the rest of the world. The Americas was central to this strategy from the start.

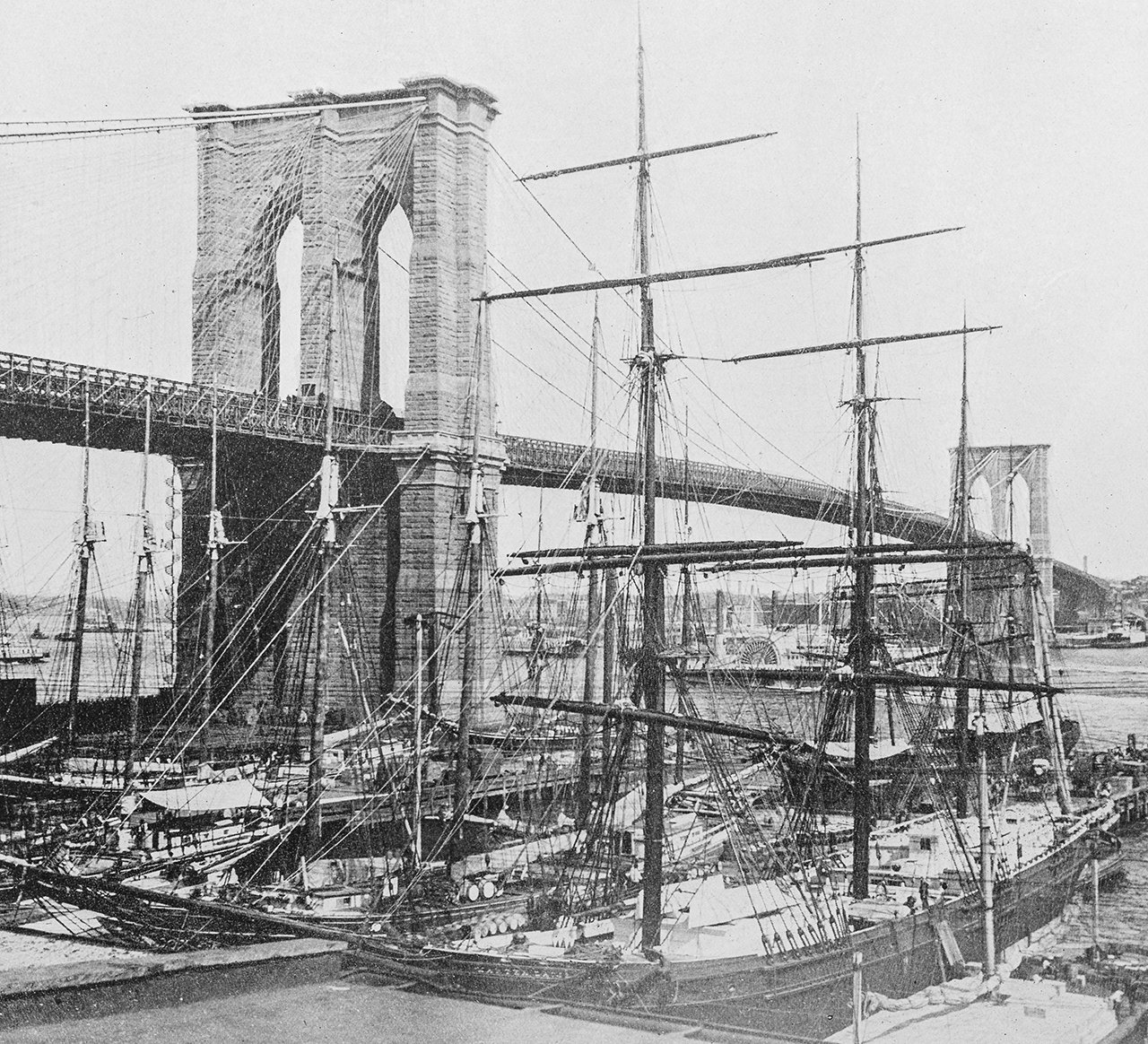

From old to new, from coast to coast, we’ve been connecting the Americas for 150 years.

Before the popularization of the hamburger or the hot dog, Deutsche Bank was connecting German expertise with American capital to move the country forward.

Deutsche Bank’s roots in the Americas go back to 1872, financing the northwestern expansion of the railroad through Wisconsin, Minnesota, North Dakota, Montana, Idaho, Oregon, and Washington.

In the intervening 150 years, Deutsche Bank has continued to leverage New York’s deep and liquid capital markets to shape skylines, bring the latest innovation to market, and keep Americans moving forward.

We’ve grown together, through highs and lows. By supporting our European clients’ access to the American market, and American clients’ expansion to European and Asian markets, we’ve supported American economic growth and helped to facilitate the development of New York City as the financial capital of the world.

Deutsche Bank has been interwoven in the fabric of America, just as America is a key part of Deutsche Bank’s past, present and future.

150 years of Deutsche Bank in the Americas

1872

Network

Deutsche Bank arrives in New York to support trade and investment between the Americas and Euro

1883

Economy

Our financing of the Northern Pacific Railroad helps rail travel expand from coast to coast

1887

Economy

We begin representing clients in Latin America from our branch in Buenos Aires

1889

Economy

Our investment in Edison General Electric Company — later GE — helps bring electric power to America

1898

Economy

Our project finance enables Argentina to modernize infrastructure and adopt new technologies

1906

Economy

We help Peru export one of its most valuable commodities — salt

1927

Economy

We raise USD 25m from the US capital markets to finance German export business

1962

Economy

We enable US companies including IBM and Ford to raise finance in Europe

1979

Economy

Following the International Banking Act we open our first US branches under the Deutsche Bank name in New York, Los Angeles and Chicago

1982

Economy

We advise the Mexican government through the country’s debt crisis

1990

Economy

Our role in the US financial system grows as we become a primary dealer of Treasury bonds

1993

Economy

With our support, Daimler-Benz becomes the first German company to list on the NYSE

1998

Economy

We supply Coca-Cola with the finance to expand its global distribution network

2001

Economy

Deutsche Bank’s listing in New York underlines our commitment to the Americas

2002

Economy

We contribute to the rebuilding of New York’s financial district after 9/11 by moving our US headquarters to Wall Street

2003

Economy

The Deutsche Bank Championship is added to the PGA Tour, and goes on to generate nearly USD 700m in economic benefits and charitable donations over the next 14 years

2011

Economy

We advise Chilean winemaker Concha y Toro on its acquisition of Fetzer Vineyards, which helps it become one of the largest wine companies in the world

2012

Art

Our sponsorship of Frieze New York is part of a global commitment to improving access to contemporary art

2013

Economy

We help American Airlines navigate a period of financial turbulence to become the largest airline in the US

2014

Economy

We are a bookrunner on the largest US IPO to date, for China e-commerce giant Alibaba Group

2016

Economy

We help Argentina return to the bond market for the first time since 2001

2017

Economy

Our financing of the conversion of Farley Post Office into the Moynihan Train Hall helps bring twenty-first century rail travel to New York City

2019

Economy

Hudson Yards in New York is the largest private real estate development in US history — we help finance the project

2020

Economy

Sustainable finance for clients like Tesla helps drive the transition to a low-carbon economy

2021

Economy

Our new Americas headquarters opens in New York